Did you know grants and scholarships usually pay for $7,500 of tuition yearly? This average comes from data by the Education Data Initiative. By submitting a FAFSA (Free Application for Federal Student Aid), students open the door to many federal financial assistance options. These options help lower the costs of higher education.

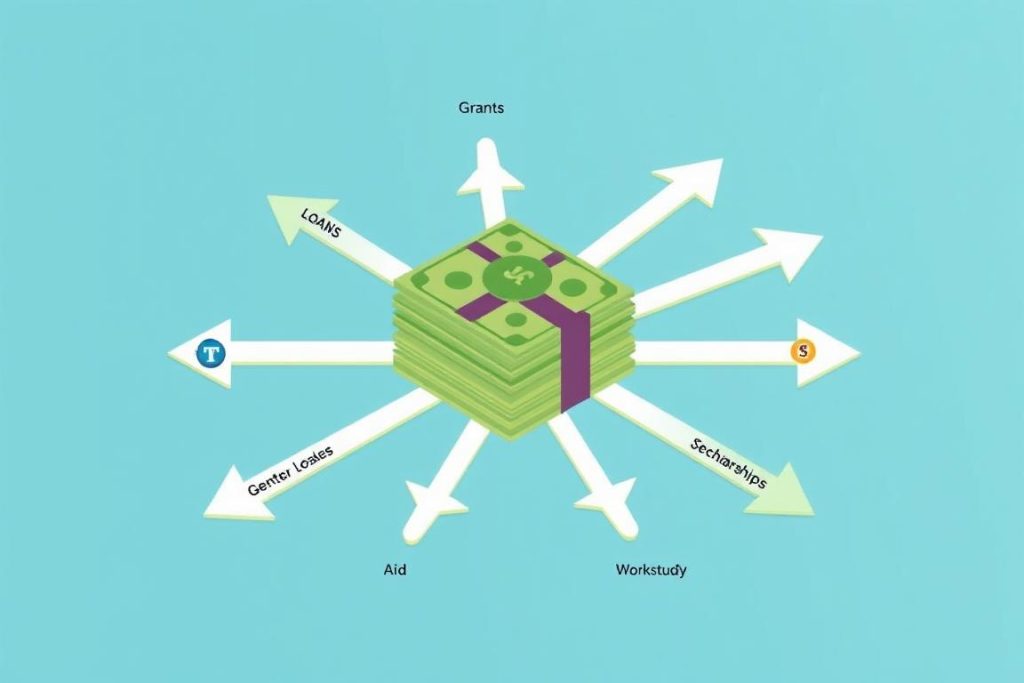

It’s very important to know your financial aid programs options. This knowledge helps in making smart choices about how to pay for college. Opportunities range from federal grant programs, like Pell Grants, to state programs for residents of Vermont through VSAC. Also, Federal Work-Study programs lets students earn money by working part-time.

Moreover, government funding and federal student loans with easy repayment plans are there to help. They help when usual financial aid packages aren’t enough. It’s key to apply for every award you qualify for. Always review your financial aid letters carefully. Consider private loans if needed. Places like VSAC offer guidance to sift through these options smoothly.

Key Takeaways

- Filing a FAFSA is the first step to accessing various federal and state grants and university-specific grants.

- VSAC offers over 150 scholarships requiring a FAFSA as part of the application process for Vermont residents.

- Federal grants, such as those from the Department of Education, play a significant role in reducing the cost of higher education.

- The Federal Work-Study program provides part-time jobs to students with financial needs, aiding them in earning extra money.

- Federal student loans offer flexible repayment options, including a six-month grace period for undergraduate loans after graduation.

Understanding Federal Grants and Scholarships

Looking for government help for college? It’s key to know about the federal grants and scholarships out there. They aim to lessen the cost for students and their families.

Types of Federal Grants

Federal grants are mainly for those in need and you don’t have to pay them back. Here are some key ones:

- Pell Grants: For undergrads who really need financial help.

- Federal Supplement Educational Opportunity Grants (FSEOG): For those with extreme financial needs.

- Teacher Education Assistance for College and Higher Education (TEACH) Grants: For students who want to teach in low-income areas.

- Iraq and Afghanistan Service Grants: For students whose parent or guardian died in military service after 9/11.

Who gets these grants depends on family income, school costs, and disability. While they offer great support, not everyone can get one due to limited spots and high demand.

How to Apply for Scholarships

Scholarships don’t need to be paid back and they’re often for achievements. They can be given for grades, sports, study areas, ethnic backgrounds, or special competitions. Here’s how to apply:

- Research: Look online and ask financial aid offices for options.

- Prepare: Get your documents, like grades, letters, and essays, ready.

- Apply: Send in your applications on time, following all the rules.

States, colleges, and private groups also give out scholarships. Applying might include forms, interviews, or writing essays.

By knowing about grants and going after scholarships, students can find more government help. This makes college less expensive and more accessible.

Maximizing Federal Loan Options for Education

Exploring federal loan options is key to managing educational costs smartly. This avoids getting into too much debt. Out-of-state public universities charge around $28,240 a year. Private schools might ask for about $39,400 annually. That’s why knowing what federal loan options there are is critical. They’re a big help in paying these fees and have benefits that private loans don’t.

Federal Student Loans

Federal loans help students and their families with school costs. They include Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans. Each serves different needs:

- Direct Subsidized Loans: These are for undergrads who need financial aid. They’re based on the Student Aid Index (SAI), new since July 2023.

- Direct Unsubsidized Loans: Both undergrads and grads can get these, with no need to prove financial need.

- PLUS Loans: These are for grad students or the parents of undergrads. They cover costs that other aids don’t.

Compared to private loans, these options have lower interest rates. This means you save money over time.

Payment Plans and Deferments

It’s essential to understand repayment plans and deferments for these loans. They have plans suited for different financial situations, such as:

- Standard Repayment Plan: You pay a fixed amount over ten years.

- Income-Driven Repayment Plans: Your payments depend on your income and family size. This is helpful if you earn less.

- Graduated Repayment Plan: Initial low payments that increase every two years. It’s good if you expect to make more money later.

Deferments let you pause payments in situations like grad school or financial hardship. This flexibility helps manage loans without stress.

Using income-driven plans can lower your monthly payments. It’s vital to borrow what you need and also look into grants, scholarships, and work-study options before loans.

| Loan Type | Eligible Borrowers | Interest Rate | Key Advantage |

|---|---|---|---|

| Direct Subsidized Loans | Undergraduate Students | Lower interest rate | Interest subsidized while in school |

| Direct Unsubsidized Loans | Undergraduate & Graduate Students | Competitive interest rate | Flexible borrowing without need criteria |

| PLUS Loans | Parents & Graduate Students | Higher interest rate | Covers full cost of attendance minus other aid |

Managing student debt wisely is crucial, especially when U.S. student debt is over $1.7 trillion. Federal aid applications start in October. Apply early, as aid is given on a first-come, first-served basis. By knowing and using federal loans wisely, students can start their college journey prepared and financially secure.

Exploring Federal Financial Assistance for Organizations

Federal financial aid isn’t just for students; it helps organizations too. The Council on Federal Financial Assistance (COFFA) is key here. Established on August 9, 2023, it’s part of a broader plan by the Biden-Harris Administration. This council has leaders from twenty-four CFO Act agencies and others, all aimed at making federal aid easier to get. With over $1 trillion available annually, many organizations can find the help they need.

Programs and Eligibility

Many programs offer funds for community-focused organizations. For example, the Federal Work-Study program supports jobs related to students’ studies and encourages community service. To get these funds, organizations often start with a FAFSA and work through grant applications. These programs support critical workforce development in key service sectors and industries.

The Office for Civil Rights also offers help, ensuring organizations don’t discriminate. They do this through webinars and trainings. Similarly, the Department of Justice connects groups to federal agencies, enhancing their impact. Recent rule changes also protect religious freedoms for service providers, affecting multiple federal departments.

Hurricane victims like Cristina show why easy access to aid matters. Organizations using these funds, guided by COFFA, aim to build trust in government and ease paperwork. This makes life better for everyone involved.

Below is a quick guide to various federal aid programs and who can apply for them. It’s great for organizations looking for support.

| Program | Eligibility Criteria | Annual Funding Amount |

|---|---|---|

| Federal Work-Study | Need-based, must file FAFSA | Varies by institution |

| Education Grants | State and federal protocols | $600 billion in FY 2015 |

| Civil Rights Compliance Assistance | Compliance with federal laws | Provided through webinars and trainings |

| Faith-Based and Neighborhood Partnerships | Community and faith-based organizations | Impacts multiple federal agencies |

Conclusion

Getting federal financial aid is key for individuals and groups to meet educational goals and boost financial stability. Understanding grants, scholarships, and loans fully helps craft a lasting plan for education funding. For instance, nonprofit hospitals gave $14.2 billion in aid in 2017, showing the big difference these funds can make.

It’s vital for students and group leaders to actively look for the right aid. They need to talk well with aid offices and keep track of deadlines. Back in 1989-90, 44% of college students got federal aid. This shows how many chances there are. For more info, look into this detailed analysis of federal financial aid from The Yale Law Journal.

Seeking financial aid isn’t just about getting money. It’s about laying the groundwork for a future filled with chances and success. Education opens doors to financial growth and helps build stable funding methods. This lifts up both people and communities. With funds like New Jersey’s $319 million Health Care Subsidy Fund or Massachusetts’ $387 million Health Safety Net, the benefits are obvious. Utilizing these resources means not missing vital chances to better one’s educational and financial paths.